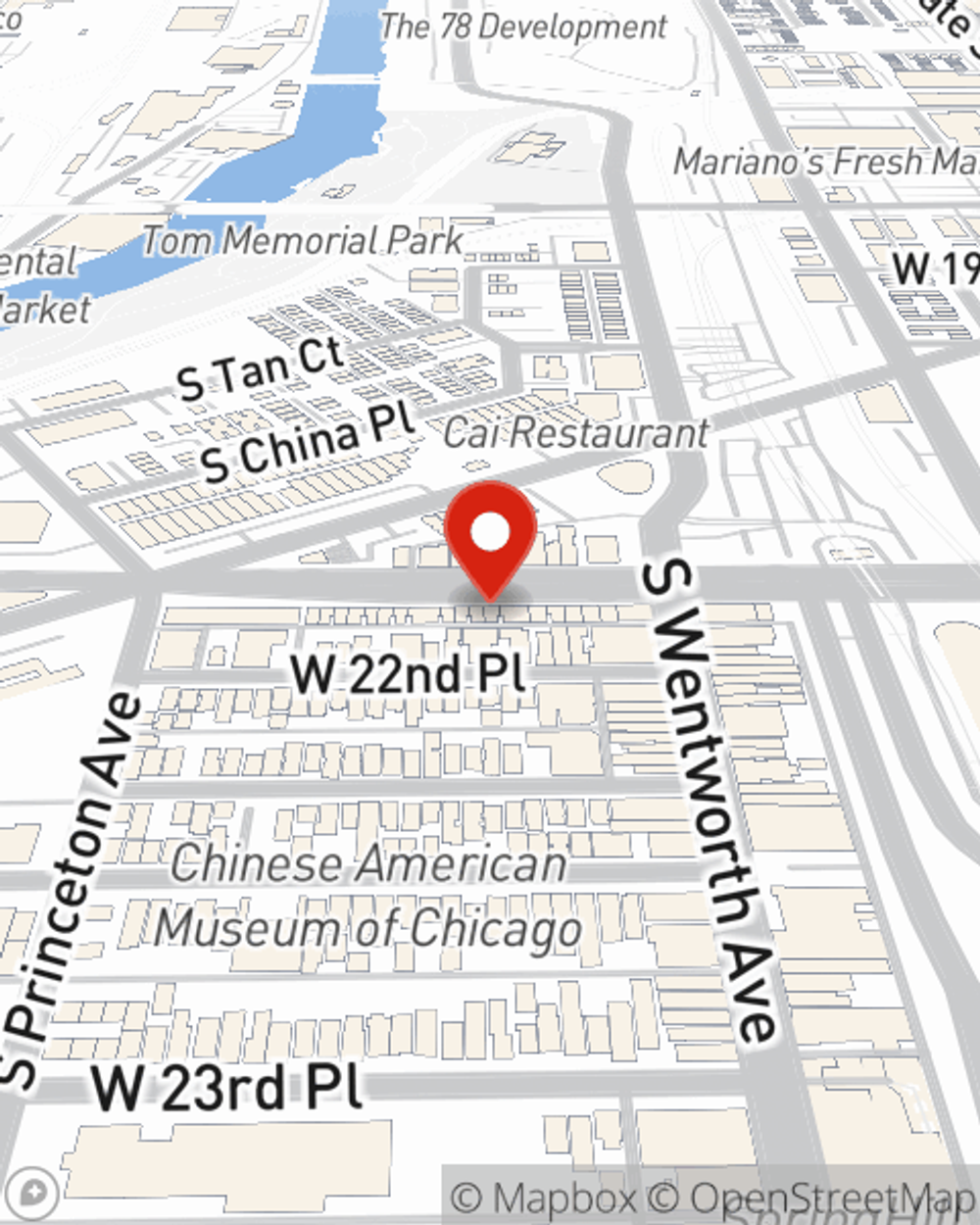

Life Insurance in and around Chicago

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

There's a common misconception that Life insurance isn't necessary when you're still young, but even if you are young and a recent college graduate, now could be the right time to start thinking about Life insurance.

Get insured for what matters to you

Life happens. Don't wait.

Why Chicago Chooses State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific time frame coverage for a specific number of years or another coverage option, State Farm agent Tad Tran can help you with a policy that can help cover your loved ones.

Regardless of where you're at in life, you're still a person who could need life insurance. Contact State Farm agent Tad Tran's office to determine the options that are right for you and your family.

Have More Questions About Life Insurance?

Call Tad at (312) 225-8311 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.