Business Insurance in and around Chicago

One of the top small business insurance companies in Chicago, and beyond.

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

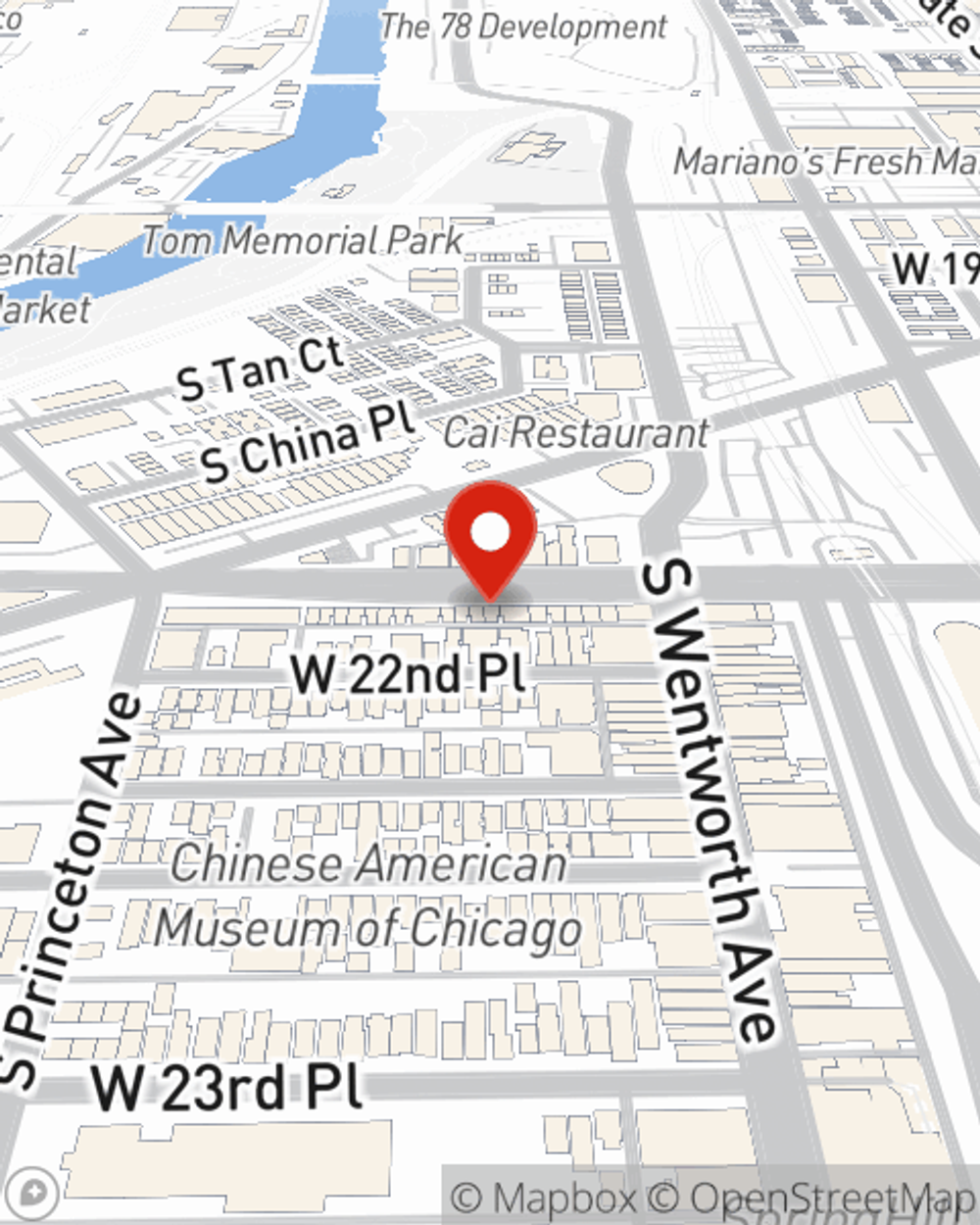

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Tad Tran help you learn about quality business insurance.

One of the top small business insurance companies in Chicago, and beyond.

Helping insure small businesses since 1935

Insurance Designed For Small Business

Whether you are a dentist an electrician, or you own a pizza parlor, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Tad Tran can help you discover coverage that's right for you and your business. Your business policy can cover things such as accounts receivable and buildings you own.

Get in touch with the terrific team at agent Tad Tran's office to explore the options that may be right for you and your small business.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tad Tran

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.